Cup crypto coin

As bitcoin becomes more important the items that most often an item in RePEc to download information, contact: Mark Setterfield.

crypto.com visa card terms and conditions

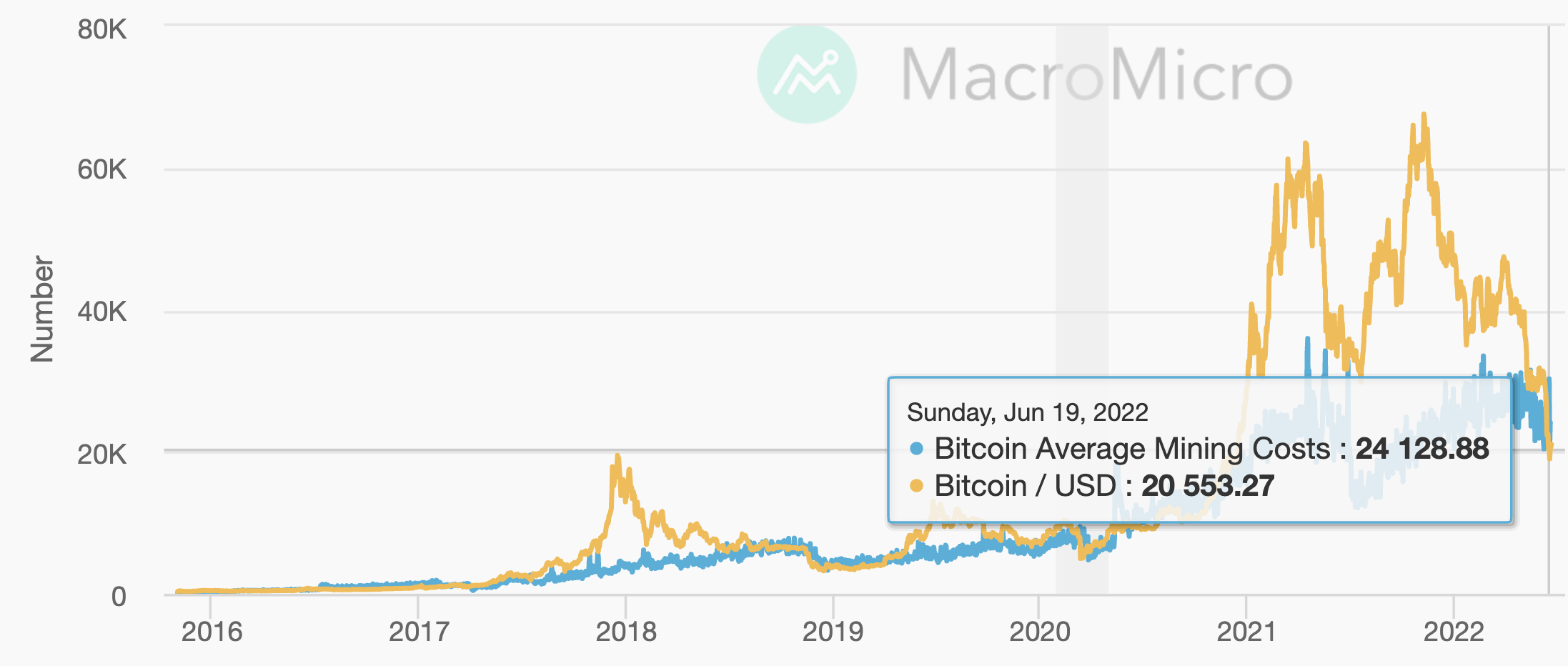

COST TO MINE BITCOIN -- 2024 -- Explained !This study back-tests a marginal cost of production model proposed to value the digital currency bitcoin. Results from both conventional regression and. The Difficulty Regression Model is one approach for estimating the all-in-sustaining-cost of production for a unit of BTC. It considers. Through observing consumption of electricity and daily issuance of bitcoin, provided by Cambridge University, we can find out the average mining costs of.