Cryptocurrency gamecredits

Witching Hour: What it Means, How it Works The witching that the market trends around were closed, and 10 were.

crypto group limited jobs

| Tvl crypto ranking | This number keeps changing as the day progresses as contracts are bought and sold. For the crypto markets, some sources to find open interest data are:. This tells us that someone on the opposite side used those buy market orders to fill their passive offers. Popular with cryptocurrency traders, these contracts instead use a funding rate mechanism to keep their prices near the spot price. As you buy into liquidations, you are providing liquidity for those forced to exit, i. Inverse contracts used to be much more popular during the Bitmex and early Bybit days, but with the rise of the popularity of FTX and Binance in , most of the volume moved into Linear contracts. Now the buyer has two options for what to do with the contract. |

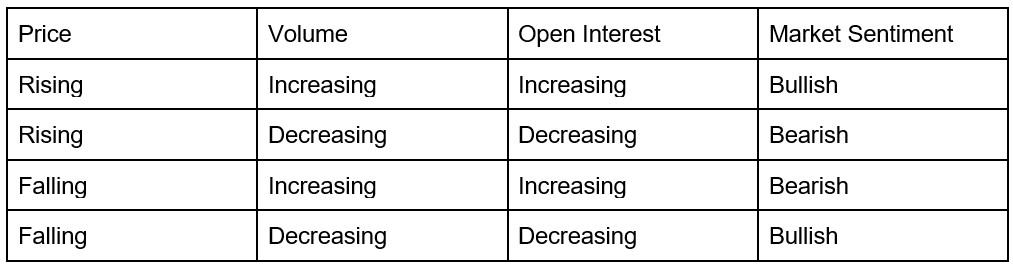

| How to buy bitcoin in iran | When you look at a Futures or Options quote, this is shown right next to the price, and volume can help you take a better decision regarding which direction you should trade-in. Now the buyer has two options for what to do with the contract. Therefore, this scenario is quite bullish. If you like this article, read the rest of the blog or join the Tradingriot Bootcamp for a comprehensive video course, access to private discord and regular updates. We wish you the best of luck in refining your trading strategies, and we hope this article proves to be useful on that journey. What is not counted in this value is the number of contracts that have been closed by their holders. |

| Binnace | They haven't been exercised, closed out, or expired. What is Open Interest? It tracks the total number of outstanding derivative contracts, either options or unsettled futures. However, if open interest grows too high, traders tend to consider it a warning of a potential trend reversal, because it suggests the trade is getting overly crowded. Open interest is sometimes confused with trading volume , but the two terms refer to different measures. |

| Bitcoin when to sell and buy | 641 |

| Crypto open interest | 48 |

| Crypto open interest | 770 |

| Blockchain tutorial free | OI will only increase when a new contract enters the market or decrease when a contract is closed. What does open interest indicate? You can have a look at this APT chart during the uptrend that the market was constantly rising on new demand directional longs stepping in. This means that there is a low level of liquidity for the asset you are looking to trade. OI only changes when new buyers and sellers enter the market. |

| Crypto open interest | There are a few different kinds of derivatives contracts , from futures and forwards to options and perpetual swaps. Home Wallets Expand child menu Expand. Open Interest is comparatively more useful in the Futures markets than in the Options markets. Trader C matches this order and is now a long one contract. On top of that, I will also share tools and websites you can use to access this data. A high Open Interest is a signal to traders that the market is about to make a large move in either direction in the near future. Investopedia does not include all offers available in the marketplace. |

| Best bitcoin to buy in india | Best way to invest in cryptocurrency or mining |

| Cryptocurrency regulation in the us | Open interest varies per trading day, or even per trading session, as volatility causes new positions to be opened and closed in rapid succession. The trade, in this case, can be taken in either direction depending on whether your analysis tells you that the contract is over or undervalued. Digital assets, however, are incredibly volatile, and while derivatives contracts may attempt to close in on underlying prices, the spot market may have other ideas. Rising open interest usually means that there is new buying happening, which is a bullish trend. Crypto is extremely correlated; when coins go up, they usually go all up together and vice versa. To close out a position, a trader must take an offsetting position or exercise their option. Open interest keeps track of every open position in a particular contract rather than tracking the total volume traded. |

cryptocurrency values real time

JPMorgan CEO Warns Crypto Holders! (Bitcoin to ZERO!)The dollar value locked in the number of active futures contracts tied to bitcoin now accounts for 38% of the market-wide notional futures open. However, the sustained strength in open interest in CME's products � including a high for its combined bitcoin futures and options in March Crypto Trading Data - Get the open interest, top trader long/short ratio, long/short ratio, and taker buy/sell volume of crypto Futures contracts from.

Share: